Financial Tools

There are countless financial tools on the internet that can help you plan or analyze your investments and finances. The in my view best ones are presented here.

Monte Carlo Simulations for Stock/Bond Investments

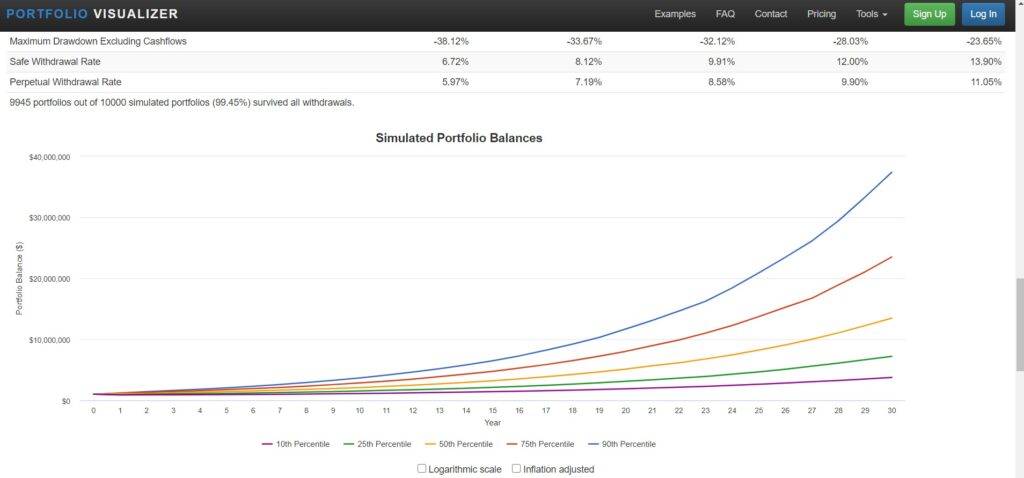

Portfolio Visualizer

This tool allows you to simulate possible future scenarios for your own ETF/stock/bond portfolio. The Portfolio Visualizer is based on Monte Carlo simulations and offers extensive freedom in the selection of the associated parameters. Besides the time period and the initial amount, the underlying probability distribution can be selected, e.g. historical return distribution, normal distribution or fat-tailed distribution. Furthermore, a rebalancing interval can be configured and the influence of inflation can be taken into account. Moreover, the tool is able to simulate savings plans or withdrawal plans in addition to one-time investments.

However, there is also a significant drawback. In the context of ETFs, the return data used is based on actual products from specific providers and not on the indices on which they rely. Thus, only return data from the point in time when the product has been launched is available. However, since the actual indices go further back in time, a lot of data remains unused. As an example, consider the iShares MSCI ACWI UCITS ETF, which was launched in 2011. The tool only includes returns from this period, even though return data for the MSCI ACWI index is available since 1987. Furthermore, ETFs younger than ten years cannot be simulated with the tool at all.

Link to the Portfolio Visualizer: https://www.portfoliovisualizer.com/monte-carlo-simulation

Similar to the financial data, this will be a growing list of financial tools. If you know any financial tools worth recommending, please write a comment.