Consumers want to buy products from companies that reflect their personal values. Although price is still the most important purchasing argument for consumers, the sustainability of goods such as environmental protection, the avoidance of child labor or fair working conditions are becoming increasingly important. [1] The promise of ESG and SRI index funds is to enable investors to invest in companies that meet certain sustainability criteria.

The acronym ESG stands for “Environment”, “Social” and “Governance”. In order to determine the sustainability of companies, criteria are defined for each of these areas against which the companies are evaluated. The abbreviation SRI stands for “Socially Responsible Investing” and is broadly synonymous with ESG.

Meanwhile, a profitable business has emerged around the rating according to ESG criteria. Investments in assets that have been filtered through some form of ESG criteria have increased by 34% from 2016 to 2019. [2] The agencies behind ESG ratings face the difficult challenge of accurately measuring and ranking a company’s environmental and social impact against objective criteria. However, as ESG is still an evolving concept with no firmly defined standards, there can be some significant differences in how companies are rated by different agencies.

Another main criticism of indices filtered according to ESG criteria is the sometimes significant reduction in diversification. If ESG criteria are applied strictly, many companies and in some cases entire sectors no longer make it into an index.

In this blog post, we want to look specifically at indices from the provider MSCI that are filtered according to ESG criteria and in which private investors can invest via ETFs. First, we will look at the implementation problems with ESG ratings, which ultimately lead to the fact that there is sometimes a large scattering of ESG ratings from different agencies. We will then discuss the rating guidelines that MSCI uses to determine the ESG rating of companies.

Since the assessment of social and environmental issues is highly influenced by subjective ideological factors, we will present websites that investors can use to see for themselves which ESG rating a company has received from a particular rating agency. We’ll use some examples to demonstrate that even strictly filtered indices contain companies whose sustainability would likely be questioned by some investors. And we will look at the impact ESG criteria have on the foundation of passive investing – diversification in equity investments.

What are the challenges in defining ESG/SRI criteria?

Rating agencies that evaluate companies based on ESG criteria must accurately measure a company’s environmental and social impacts and rank them using objective criteria. However, the assessment of social and environmental circumstances is strongly influenced by individual worldviews. As a result, there is no definitive agreement on what constitutes suitable sustainability criteria in the first place and how they should be weighted. Investors and rating agencies are affected by this problem. The same circumstances can result in sometimes contradictory ratings from different rating agencies. Here are some examples that illustrate the dilemma:

- A company’s labor practices are assessed by workforce turnover for some agencies and by the number of labor lawsuits filed against the company for other agencies. Both metrics capture aspects of the labor practices attribute, but they are likely to result in different scores.

- Genetic engineering is probably viewed critically by most people in Europe. There are index funds filtered according to ESG criteria in which all companies active in the field of genetic engineering are filtered out. For some scientists, however, genetic engineering is the most promising way to combat malnutrition in the poorest regions of the world. One example is so-called golden rice, which has been genetically engineered to enrich it with vitamin A. It could play an important role in the fight against vitamin A deficiency, which leads to the deaths of an estimated 670000 children each year. [3]

- The question arises, at what time should a commodity producer that has supplied the arms industry in the past be allowed back into an ESG index?

One could add countless other ethical dilemmas and scientific principle debates from the three ESG areas of environment, social and governance to this list.

The vagueness in the definition of sustainability means that the ratings of different providers differ, sometimes significantly. In a study by the Massachusetts Institute of Technology, researchers examined the ratings of six established ESG rating agencies: KLD (MSCI Stats), Sustainalytics, Vigeo Eiris (Moody’s), RobecoSAM (S&P Global), Asset4 (Refinitiv), and MSCI. [4] The correlation between each agency’s ratings ranges from 0.38 to 0.71 with an average of 0.54. When this is compared to the correlation between Moodys and Standard & Poors credit ratings of 0.99, it is clear that ESG ratings fare considerably worse.

The information investors receive from ESG rating agencies is thus inaccurate and sometimes contradictory. This results in two major consequences:

- It is less likely that good ESG performance is actually reflected in companies’ share prices, as outperformers and laggards are not clearly identifiable. Even if a significant portion of investors have a preference for companies with good ESG performance, this effect dissipates due to ratings divergence.

- Companies seeking to improve their ESG performance receive mixed signals from rating agencies about what actions the market expects and how they will be evaluated.

The authors of the study also address the causes of the divergence in the agencies’ ratings. Three factors play a decisive role here:

- Differences in the factors taken into account by the agencies. For example, lobbying is not considered by all agencies in their ESG criteria. Responsible for 36.7% of the deviations.

- Varying weighting of individual factors. There is no uniform model for weighting the individual factors, for example, how heavily human rights violations should be weighted compared to environmental failures or lobbying efforts. Responsible for 13.2% of deviations.

- Different indicators used to measure the same criterion. Here, the example already mentioned above applies as to whether a company’s labor practices should be assessed on the basis of staff turnover or the number of labor law suits against the company. Responsible for 50.1% of the deviations.

MSCI ESG/SRI Framework

The index provider MSCI has developed its own ESG framework with which companies are assessed in terms of their sustainability. Since ESG risks and opportunities can vary greatly from industry to industry, MSCI identifies key themes for each GICS (Global Industry Classification Standard) sub-industry, which are used to evaluate companies relative to their peers (you can find out how the GICS industry classification standard works here). For this, MSCI has developed 35 key themes in the three ESG areas of environmental, social and governance, ranging from C02 emissions to data privacy to tax transparency. [5] All companies are evaluated in terms of corporate governance.

For each key topic of a sub-industry, MSCI subsequently defines risks and opportunities. Depending on the risk exposure (determined individually for each company) and how the company deals with this risk, MSCI assigns a score. The same procedure applies to the opportunities of a key topic.

In addition to the opportunities and risks of a sub-industry and how companies deal with them, MSCI also calculates a so-called Controversy Score at company level. MSCI defines a controversy as an occurrence or ongoing situation in which companies and/or products are alleged to have negative environmental, social and/or governance impacts. A case is typically a single event, such as a spill, an accident, a regulatory action, or a series of closely related events or allegations. Examples include the Volkswagen diesel scandal or the leak from the Deepwater Horizon drilling platform, which was operated on behalf of BP. Controversies have a negative impact on companies’ ESG scores depending on their severity.

An overall ESG score is calculated for the companies on the basis of the industry-specific key themes and their weightings, which are updated annually by MSCI, and the Controversy Score. The scale ranges from Leader (AAA, AA) to Average (A, BBB, BB) to Laggard (B, CCC).

ESG ratings of individual companies

MSCI offers the possibility to access the ESG ratings for all 2800 companies that are part of the MSCI ACWI via the following website:

https://www.msci.com/our-solutions/esg-investing/esg-ratings/esg-ratings-corporate-search-tool/

In addition to the general ESG score, the tool provides information on the development of the ESG score over time for the last five years. It also outlines how companies perform on each of the key industry-specific topics.

Let’s take the food company Nestlé, which is often criticized with regard to sustainability issues, as an example. The company is rated as a leader by MSCI in the key areas of “Corperate Governance,” “Opportunities in Nutrition and Health,” “Water Stress,” “Raw Material Sourcing,” and “Product Carbon Footprint,” among others, but is classified as a laggard in the two areas of “Corperate Behavior” and “Supply Chain Labor Standards.” Nevertheless, Nestlé receives an overall Leader rating in the food industry from MSCI, even though Nestlé performs below average in terms of supplier labor conditions, according to MSCI.

I will not go into whether the scores in the individual categories are justified here, but the example illustrates in my opinion, that it is difficult to weigh up different sustainability issues such as working conditions and C02 emissions. It is not possible to reflect the complexity of sustainability in a single score.

If you now look at the ESG ratings of other agencies, the picture becomes even more diffuse for investors who want to base their investments on ESG ratings. Another agency that publicly displays its ratings on the Internet is Sustainalytics from Morningstar:

https://www.sustainalytics.com/esg-ratings

Unlike MSCI, Sustanalytics only gives Nestlé an ESG rating of Medium, the average category of Sustainalytics. One reason for this is the high Controversy Score that Nestlé receives from Sustainalytics. Incidents in the area of “Environmental Supply Chain,” the very area in which Nestlé is rated as a leader by MSCI, also contributed to this rating. Exactly which incidents these were and how the scoring for a specific company is arrived at are not explained transparently by either MSCI or Sustainanalytics. The example of Nestlé illustrates that the rating of different agencies with regard to ESG performance is by no means uniform and in some cases even contradictory.

ESG indices and diversification

In addition to the ESG ranking of individual companies, MSCI also provides indices that have been filtered for ESG criteria in their composition. Depending on how strictly these criteria are applied, there can be a significant reduction in the number of companies that remain after screening. This results in the problem of reduced diversification for investors. As investing in ESG indices is no longer a niche, index providers are trying to address the problem of reduced diversification through various measures, partly by softening the ESG criteria.

We will look at some ESG indices that are based on the MSCI World below. On the following website of MSCI you can check the composition of all MSCI indices:

https://www.msci.com/constituents

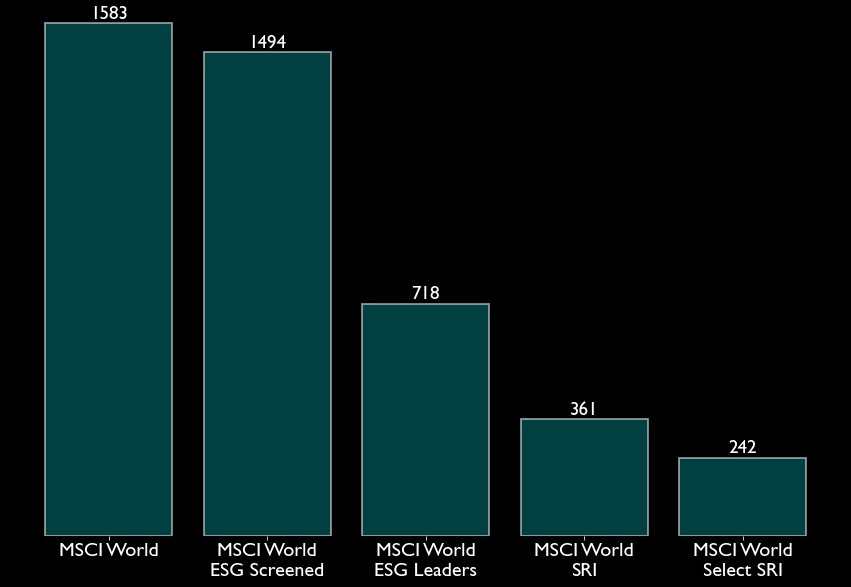

As a reminder, the MSCI World includes stocks from the 23 developed countries and contains 1583 positions responsible for approximately 85% of the market capitalization.

First, we look at the MSCI World ESG Screened, which, with around 1494 positions, contains only marginally fewer positions than the MSCI World. However, this index does not use the ESG ratings of companies for filtering, but excludes certain industries and neglects companies that violate the so-called United Nations Global Compact Principles. Excluded sectors include controversial weapons, nuclear weapons, civilian weapons, tobacco, thermal coal and oil sands. The index has a clear definition of which companies are filtered out and diversification hardly suffers compared to the MSCI World.

The MSCI World ESG Leaders index filters companies based on their ESG ranking, which they have received from MSCI. The goal of the index is to reach 50% of the market capitalization of the MSCI World for each sector and region and to include only the companies with the best ESG ratings. However, contrary to what the naming of the index suggests, this does not include only leaders that score above average on ESG criteria compared to their sector peers. Instead, in order to maintain the original country and sector weighting of the MSCI World and not introduce additional systematic risk, companies with an ESG rating of at least BB (the third worst ranking) and a Controversy Score greater than or equal to 3 are also included.

Compared to the original MSCI World index, the number of companies decreases to 718. The index thus contains less than half the companies of the MSCI World. Some heavyweights such as Apple, Amazon and Meta fall victim to ESG screening. Companies from controversial industries that fell out of the MSCI World ESG Screened are also filtered out in the MSCI World ESG Leaders.

The MSCI World SRI contains only 361 positions and is therefore much less diversified than the MSCI World. This can also be seen in the weighting of the individual positions. Microsoft here had a weighting of 12.58%, while the weighting in the MSCI World was only 3.22% (May 2021). To counteract this considerable cluster risk, MSCI has added the MSCI SRI 5% Issuer Capped, in which a single position can have a maximum weight of 5%. The MSCI World SRI also neglects some of the most valuable companies in the world, like Apple, Amazon, Meta, Alphabet, JP Morgan Chase and Johnson & Johnson.

Furthermore, the strict filtering according to MSCI’s ESG criteria by no means entails that only undisputedly sustainable companies are included in the index. If, for example, investors are concerned about the fight against plastic waste in the world’s oceans, the MSCI World SRI still includes five companies that, according to Greenpeace, are among the Top 10 global plastic waste producers: PepsiCo, Danone, Procter & Gamble, Unilever and Colgate-Palmolive. [6]

There are many other indices filtered according to ESG criteria, some of which are even more stringent, e.g. the MSCI World Select SRI Index. However, there are also indices where the criteria are softened further, e.g. by including companies that underperform but whose ESG score shows a positive development.

Conclusion

- As there is no universally accepted definition of sustainability, the ESG ratings of established rating agencies differ significantly in some cases. The correlation of ESG ratings of the market-leading agencies is on average only 0.54 and is therefore in no way to be confused with objective ratings, for example regarding the creditworthiness of a company. How sustainability is defined in concrete terms is highly dependent on an investor’s individual values, and in my opinion the topic cannot be mapped with a simple ESG score due to its complexity.

- Nevertheless, ESG indices such as the MSCI World ESG Screened, offer the possibility to at least filter out particularly controversial industries such as nuclear weapons, tobacco, etc.

- Strict filtering according to ESG criteria leads to a significant reduction of the companies included in an index and thus results in a poorer diversification. Whether ESG screening actually filters out all controversial companies remains questionable to me.

- An alternative and more efficient way to screen out companies with questionable business practices remains one’s own consumption decisions.

Sources

[1]: Ernst & Young, https://www.ey.com/de_de/news/2020/05/ey-nachhaltiger-konsum-2020

[2]: MIT Sloan School of Management, https://mitsloan.mit.edu/ideas-made-to-matter/why-esg-ratings-vary-so-widely-and-what-you-can-do-about-it

[3]: Black RE et al., Maternal and child undernutrition: global and regional exposures and health consequences, The Lancet, 2008, 371(9608), p. 253.

[4]: MIT Sloan School of Management, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3438533

[5]: MSCI, https://www.msci.com/our-solutions/esg-investing/esg-ratings/esg-ratings-key-issue-framework

[6]: Greenpeace, https://www.greenpeace.org/international/story/18876/these-10-companies-are-flooding-the-planet-with-throwaway-plastic/